Finance

低保費,高保障:自願醫保計劃長者的最佳選擇

你知道嗎?在香港,私家醫院一日住院費已突破港幣8,000元,而癌症標靶治療一年可能達港幣600,000元。有調查指出,超過53%市民曾因醫療費過高延誤治療,嚴重影響健康與生活質素。

日本の生命保険購入ガイド:適切な保障と優良な保険会社の選び方

生活リズムの変化や医療費の増加に伴い、多くの日本人が生命保険への関心を高めています。家庭の経済的な安全や自身の健康リスクを管理するためには、適切な保険選びが重要です。しかし、多種多様な商品や保険会社が存在する中で、どの保険を選ぶべきか悩む方も多いでしょう。本記事では、最新の日本の生命保険市場の政策背景と主要な保険会社を踏まえ、購入のポイントを解説します。さらに、比較表を用いて各社の特徴やメリット・デメリットを示し、賢い選択の参考としていただけます。

ゆうちょ銀行のローンサービス概要:低金利、柔軟な選択肢、多様な資金ニーズへの対応

ゆうちょ銀行は、住宅ローン、自動車ローン、信用枠ローンなど、さまざまなローンサービスを提供し、さまざまな顧客の金融ニーズに対応しています。同社のローン商品は、低金利、申し込みの簡便さ、返済の柔軟性といった利点があり、初めて住宅を購入する人、自動車を購入する人、短期的な資金回転を必要とする個人に適しています。ゆうちょ銀行の主なローン商品とその特徴について詳しくご紹介します。

Why Is Food at Disneyland So Expensive?

Regarded as the happiest place on earth, Disneyland is a dream vacation spot for myriads of visitors every year. But when it comes to one particular aspect of the Disneyland experience that typically annoys us, that'd be the food prices. Here are a few reasons for the steep price.

The Rise of the Fitness Economy

The fitness industry has exploded in popularity, becoming an global multi-billion-dollar industry and an increase in societal values. This article examines the forces sustaining this booming industry.

Saving vs. Spending: Striking the Right Balance

The question between saving and spending is more relevant than ever in a fast-moving world today. Finding the right balance between the two is essential both for achieving a measure personal well-being and for financial survival. Here are the guidances.

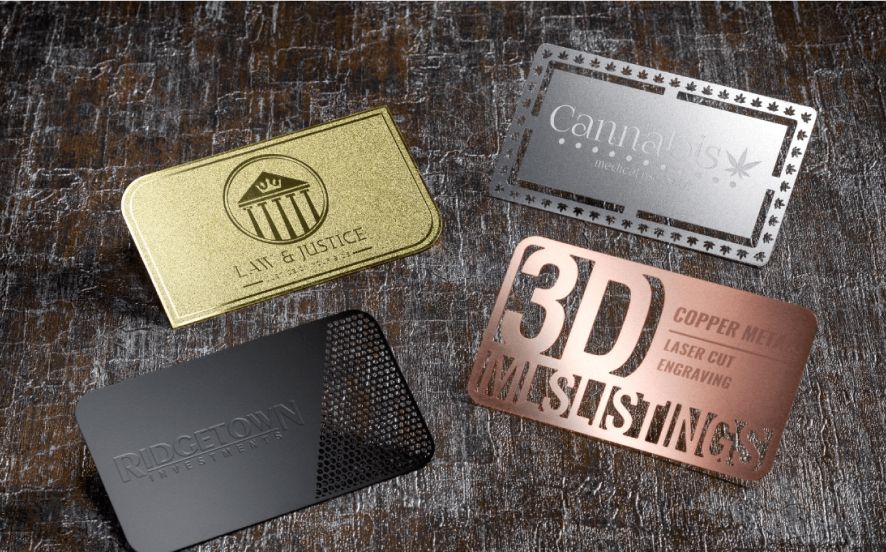

Hidden Logic Behind Membership Cards: Do Customers Really Benefit?

Membership cards fill every corner of today's consumer-driven world. But under the guise of offering “free” perks is a clever strategy aimed at bringing in customers while benefiting the company just as much. So, do they come to the advantage of customers? Let's take a look.